Thus, you can always find the break-even point (or a desired profit) in units and then convert it to sales by multiplying by the selling price per unit. Alternatively, you can find the break-even point in sales dollars and then find the number of units by dividing by the selling price per unit. At 175 units ($17,500 in sales), Hicks does not generate enough sales revenue to cover their fixed expenses and they suffer a loss of $4,000.

Introducing a new product or service

When your company reaches a break-even point, your total sales equal your total expenses. This means that you’re bringing in the same amount of money you need to cover all of your expenses and run your business. The algorithm does the rest for you – it automatically calculates your profit margin and markup, and your break-even point both in terms of units sold and cash revenue. If you have specified your sales expectations, you will even see how much time it will take to reach the BEP. If you won’t be able to reach the break-even point based on your current price, you may want to increase it.

Break-even Point In Sales Dollars

By knowing at what level sales are sufficient to cover fixed expenses is critical, but companies want to be able to make a profit and can use this break-even analysis to help them. Ethical managers need an estimate of a product or service’s cost and related revenue streams to evaluate the chance of reaching the break-even point. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. how sales commissions are reported in the income statement The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. In computing for the BEP in dollars, contribution margin ratio is used instead of contribution margin per unit. Calculating the break-even point in sales dollars will tell you how much revenue you need to generate before your business breaks even.

Break-even Point In Units

So, he decides to calculate the break-even point, so that he and his management team can determine whether this new product will be worth the investment. The latter is a similar calculation, but it’s based around knowing how much you bring in over a certain period of time. It might be a good idea to come back to this break-even calculator after you actually start doing business.

- With the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit.

- An IT service contract is typically employee cost intensive and requires an estimate of at least 120 days of employee costs before a payment will be received for the costs incurred.

- This margin indicates how much of each unit’s sales revenue contributes to covering fixed costs and generating profit once fixed costs are met.

- Eventually the company will suffer losses so great that they are forced to close their doors.

2: Calculate a Break-Even Point in Units and Dollars

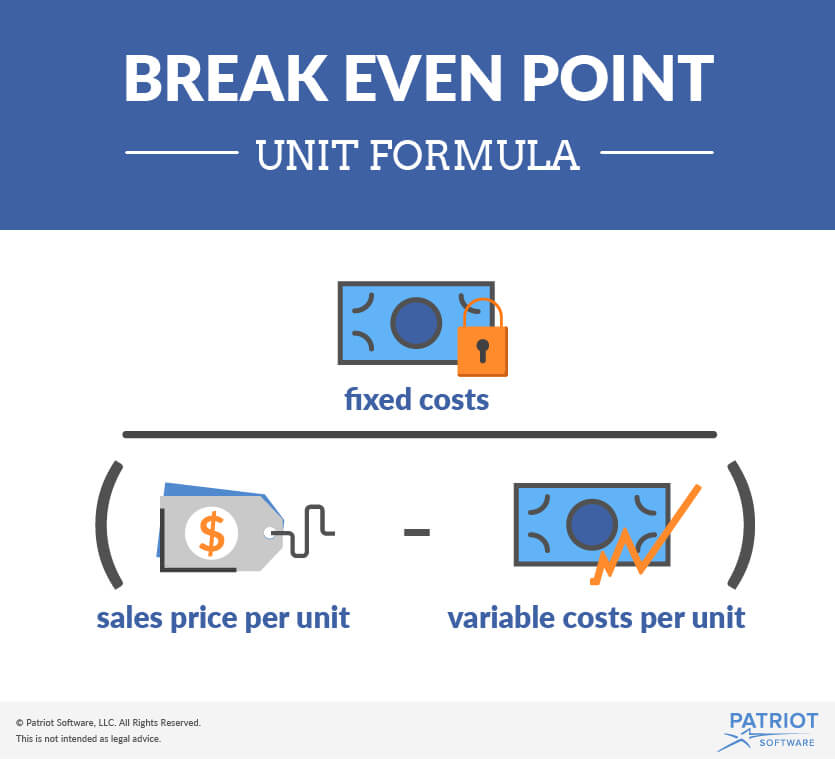

Similarly, If a competitor starts offering big discounts, your projected sales might drop and may cause you to miss your break-even point. The formula for calculating the break-even point (BEP) involves taking the total fixed costs and dividing the amount by the contribution margin per unit. The break-even point can be affected by a number of factors, including changes in fixed and variable costs, price, and sales volume.

Barbara is the managerial accountant in charge of a large furniture factory’s production lines and supply chains. Alternatively, the break-even point can also be calculated by dividing the fixed costs by the contribution margin. The basic objective of break-even point analysis is to ascertain the number of units of products that must be sold for the company to operate without loss. In other words, the no-profit-no-loss point is the break-even point. This point is also known as the minimum point of production when total costs are recovered. At the break-even point, the total cost and selling price are equal, and the firm neither gains nor losses.

Tracking this data over time can help you identify patterns — e.g., slower sales during specific months — so you can adjust your strategy based on those trends. Typically, this analysis works best for businesses that focus on a single product or service. The analysis becomes more complex and less accurate if you offer a wide range of products with different price points and variable costs. For example, If you sell both high-end electronics and low-cost accessories, a single break-even analysis won’t account for the differing profit margins. You’d need individual analyses for each product category to get a more accurate picture of your profitability. The contribution margin is determined by subtracting the variable costs from the price of a product.

For example, your break-even point formula might need to be accommodate costs that work in a different way (you get a bulk discount or fixed costs jump at certain intervals). This $40 reflects the revenue collected to cover the remaining fixed costs, which are excluded when figuring the contribution margin. Finally, the breakeven analysis often ignores qualitative factors such as market competition, customer satisfaction, and product quality. While the breakeven point focuses on financial metrics, successful business decisions also require a holistic view that looks outside the number. For example, it may just not be feasible to sell 10,000 units given the current market for the example above. As you can see, the $38,400 in revenue will not only cover the $14,000 in fixed costs, but will supply Marshall & Hirito with the $10,000 in profit (net income) they desire.

This means Sam needs to sell just over 1800 cans of the new soda in a month, to reach the break-even point. Sales Price per Unit- This is how much a company is going to charge consumers for just one of the products that the calculation is being done for. Also, remember that this analysis doesn’t take into consideration the present vs. future value of your funds. See the time value of money calculator for more information about this topic. No, the break-even point cannot be used to predict future profits. It is only useful for determining whether a company is making a profit or not at a given point in time.

You would need to make $12,000 in sales to hit your break-even point. Check out some examples of calculating your break-even point in units. You need to be very careful with the interpretation and application of a break-even number.

The contribution margin represents the revenue required to cover a business’ fixed costs and contribute to its profit. With the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit. To find the total units required to break even, divide the total fixed costs by the unit contribution margin. Break-even analysis involves a calculation of the break-even point (BEP).