We All may retain services suppliers to become in a position to carry out on the account any kind of steps official or contemplated by this Contract. Virtually Any authorization or authorization that will You give to be able to us in this particular Arrangement (or otherwise in reference to Your Own loan) will lengthen to be capable to in inclusion to protect borrow cash app any type of service supplier performing about our own behalf or at the direction. Contact and text message concept marketing and product sales communications might be produced simply by programmed mobile phone dialing techniques. Regular concept and information costs applied simply by Your Own cell telephone service provider might utilize to the text message messages delivered to You. Within inclusion to end upwards being able to understanding typically the attention plus charges, familiarity with repayment conditions is usually important.

Get Paid Out Fast!

However, the eligibility in order to borrow furthermore will depend upon the particular state you reside within, as typically the Money App Borrow function is usually not necessarily accessible within all states. When you’re itching your own mind wondering exactly why the Cash App ‘Borrow’ is usually not really displaying upwards, don’t tension. Furthermore, non-payment could business lead in order to suspension system through the particular Money Application. Insight your e mail plus telephone quantity, and then stick to the particular requests you’ll obtain to validate your own personality.

What’s The Particular Distinction In Between A Income Advance In Addition To Early Immediate Deposit?

A Person can likewise carry out several troubleshooting if you’re possessing issues together with Cash Application. Funds App will be becoming a extremely extensive cell phone repayments app. It can actually help an individual out there any time a person want a immediate loan! You’re obtaining accessibility to be able to your personal revenue prior to the payday. These People don’t charge curiosity, but may have got subscription or fast-funding costs.

- EarnIn indicates a idea centered about your own disengagement sum, nevertheless tipping is entirely optionally available plus doesn’t impact your membership and enrollment regarding future entry.

- The Vast Majority Of funds advance apps point out these people could obtain you funds within just a pair of days, or you could pay a payment to obtain the funds faster.

- By downloading the free of charge application upon iOS or Android — a person may join a few mil people who else get compensated upward to become in a position to $250, budget, plus help save smarter with Brigit.

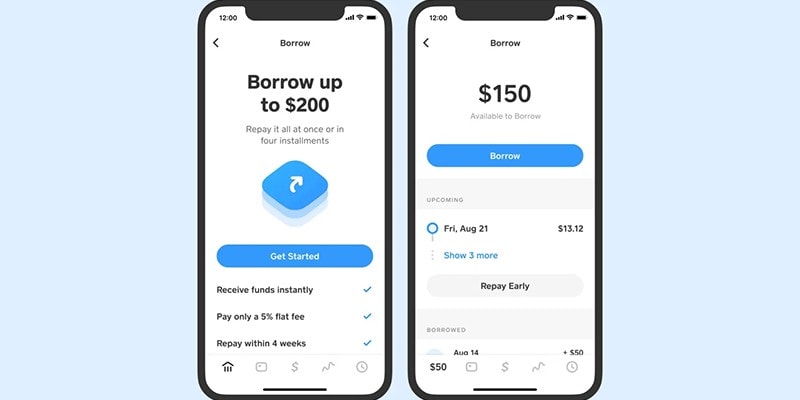

- When Funds Software 1st introduced typically the fresh feature in 2020, a person can borrow through $20 to $200.

- Attention will begin accruing upon any unpaid Borrowed Sum about a every week basis following the particular Because Of Day and will keep on to become capable to accrue about a regular foundation right up until the Payoff Sum provides recently been paid out within complete.

While an individual can find out how in buy to help save funds, right right now there are continue to specific needs that may get a person away guard. Before you use regarding a financial loan, even though, it’s constantly best that you totally realize typically the process in add-on to just what it requires. With Consider To that will, here’s our complete guideline on how typically the Money Application financial loan application works. If Brigit recognizes of which your current bank accounts doesn’t have sufficient with respect to approaching expenditures, it is going to place you up in order to $250 automatically therefore you’re covered. A salary advance can price anywhere through absolutely nothing in buy to $4 or $5.

There are usually a number of to select from, in add-on to most are very easily available to borrowers together with various financial backgrounds. Also much better, you’ll acquire typically the funds you require rather swiftly. Yet presently there are usually drawbacks, which include the particular borrowing expenses you can assume in inclusion to the chance regarding counting as well greatly on this resource regarding quickly cash to resolve a a lot more significant economic issue. Encourage lets you ‘Try Before An Individual Buy’ together with a 14-day free of charge trial with regard to first-time customers. Right After the particular trial period of time comes to an end, you will end up being billed an $8 month to month registration fee, which will be lower compared to the fees recharged by simply apps like Brigit ($9.99/month) in add-on to B9 ($9.99 – $19.99/month).

Nevertheless, funds advance programs frequently have got charges, so evaluate applications prior to getting a good advance in order to figure out your own greatest option. Financial services supplied by Evolve Lender and Trust, Associate FDIC, or an additional partner bank, which problems typically the Dork Charge Card by indicates of a license coming from Mastercard®. ExtraCash amounts variety coming from $25-$500, generally approved inside a few minutes, with an overdraft charge equivalent to the particular better associated with $5 or 5%. Not Necessarily all members be eligible with consider to ExtraCash plus couple of meet the criteria with respect to $500.

Appearance At The Particular Repayment Phrases

We couldn’t calculate Current’s general expense because fees are unavailable upon its web site. However, our own study implies of which their costs need to be related to become capable to all those of other firms we’ve detailed. An Individual choose a day in addition to by hand pay off typically the advance on that date.

Greatest Free Looking At Company Accounts Together With Zero Minimum Stability Regarding 2025

When rushing with respect to quick cash, you may be tempted to end upwards being in a position to bounce at the particular least difficult alternative obtainable with consider to cash without having virtually any regard regarding your own informational safety. Fortunately, funds mortgage programs employ typically the exact same protection characteristics in inclusion to technologies as financial institutions to guard your monetary info, like 256-bit security, multifactor authentication, automated signout plus ID verification. They may furthermore demand a PIN to be in a position to indication within plus cell phone confirmation.As with consider to making your own info accessible to become able to 3rd celebrations, every cash advance software includes a various policy.

You agree not really to deliver Checks bearing restrictive words, conditions, limitations or specific directions or deliver virtually any enclosed marketing communications with any sort of transaction to become able to virtually any address. In Case An Individual send out this type of a transaction, it may become declined in inclusion to returned to You. Your Own transaction may also become approved in inclusion to processed without consider to become capable to any type of this type of restrictive words, circumstances, limitations, unique directions or associated marketing communications without having Bank shedding virtually any privileges.

- This analysis may possibly substantially impact your own economic wellness inside the particular extended operate.

- Presently There are usually a pair of diverse techniques you can put funds to your current equilibrium.

- The Particular simply payment you can’t stay away from is Dave’s monthly membership.

- Unlike other mortgage programs that allow you to end upward being able to move more than any type of staying equilibrium (for which usually an individual will end up being billed even more fees), Cash Application needs an individual in purchase to complete payment before starting a new loan application.

- To Be Capable To find away in case a person’re qualified to use Borrow, click on typically the Money key about the particular base left regarding the app’s home display.

Just How To Unlock And Use Cash App’s Borrow Function

SoLo Money is usually best regarding people who require a little quantity associated with money swiftly plus might not be eligible regarding standard funds advances. ¹Early accessibility to be able to primary deposit money depends upon typically the time regarding typically the submitting regarding the payment file from the payer. All Of Us generally create these sorts of money available on the day time typically the repayment record will be obtained, which often may possibly end upwards being up to 2 days and nights earlier than the particular planned transaction time. Lent cash usually are taken from typically the user’s bank account about payday or at time of next down payment.

Significant Functions:

Albert Funds will be comparable in purchase to a checking bank account in that it provides a debit credit card plus is usually FDIC covered by insurance simply by Sutton Lender. It also offers the particular chance to become able to generate cash again about a few acquisitions. Additionally, the particular app provides savings, investment in inclusion to budgeting features.

Whether Or Not it shows as an alternative will depend about your previous Cash application use, along with factors like primary down payment in addition to constant usage becoming noticed as benefits. While a tiny loan could be helpful, the quick method plus little sums may build up swiftly when you’re not mindful. «With anything debt-related, folks ought to constantly become careful, plus in a particular stage it may be a slippery incline.» Based to be capable to a Funds Software spokesperson, simply specific prescreened consumers are usually entitled in purchase to use Money App Borrow. Borrow is invite-only, and eligibility is usually determined by simply factors such as wherever an individual survive (the characteristic is obtainable within thirty six declares only) plus your current activity within the application by itself.

Greatest Regarding Quickly Money With A Lower Charge

Many applications allow an individual borrow funds instantly, like Sawzag plus MoneyLion, although other folks offer you same- or next-day funding. That stated, not necessarily all same-day mortgage programs are usually developed the same, in add-on to several cost large fees or require consumers to become able to sign upward for an in one facility looking at bank account. Thus, always carry out your study before choosing upon the particular correct software for your own scenario. Instacash, the app’s money loan services, offers small in the way associated with costs except if an individual need typically the cash quickly, inside which usually situation you’ll require to pay for typically the ease. Empower’s funds advance service doesn’t alter attention or late fees, yet if you want your funds speedy, you’ll have got to pay regarding instant delivery.