In reality, prices often fluctuate due to market conditions, competition, or changes in demand. For example, if you run a café, you might decide to lower the price of your best-selling drink to attract more customers. While this could boost foot traffic, it also means your break-even point will change and you’ll need to sell more drinks to reach profitability.

Situation 2: Inflation-indexed bonds

Although investors may not be interested in an individual company’s break-even analysis of production, they may use the calculation to determine at what price they will break even on a trade or investment. The calculation is useful when trading in or creating a strategy to buy options or a fixed-income security product. A breakeven point tells you what price level, yield, profit, or other metric must be achieved not to lose any money—or to make back an initial investment on a trade or project. Thus, if a project costs $1 million to undertake, it would need to generate $1 million in net profits before it breaks even. The breakeven point is important because it identifies the minimum sales volume needed to cover all costs, ensuring no losses are incurred.

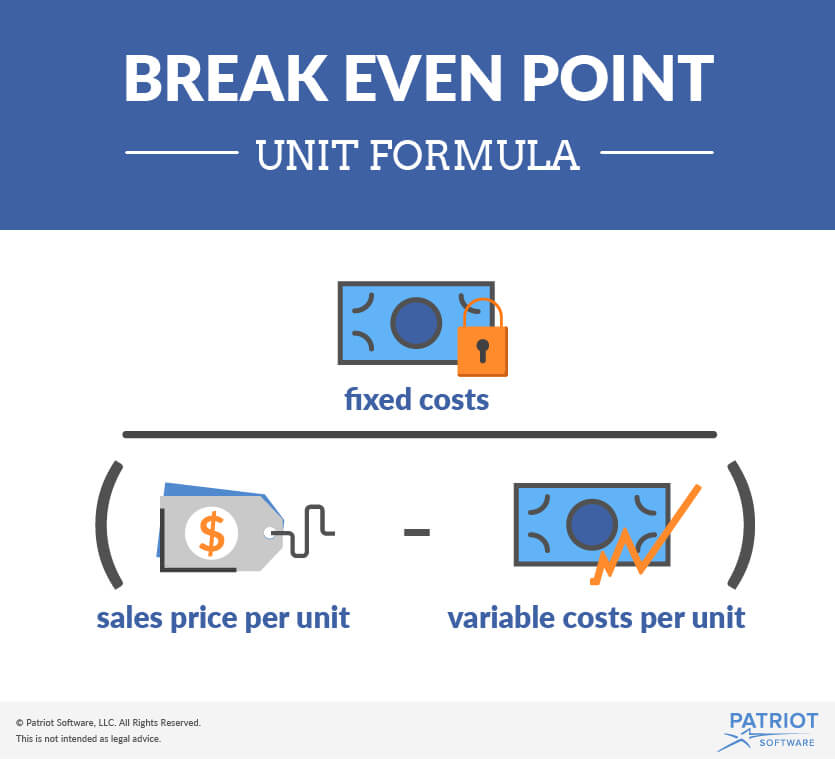

Methods to Calculate Break-Even Point

In order for your Internet business to break even, you must sell 179 units. At a price of $10 per unit, that requires a total revenue of $1,790. At this level of output your business realizes a net income of $1 because of the rounding.

How to Calculate the Break-Even Point

The latter two names are appealing because the break-even technique can be adapted to determine the sales needed to attain a specified amount of profits. However, we will use the terms break-even point and break-evenanalysis. Upon doing so, the number of units sold cell changes to 5,000, and our net profit is equal to zero. After entering the end result being solved for (i.e., the net profit of zero), the tool determines the value of the variable (i.e., the number of units that must be sold) that makes the equation true.

Because of its universal applicability, it is a critical concept to managers, business owners, and accountants. When a company first starts out, it is important for the owners to know when their sales will be sufficient to cover all of their fixed costs and begin to generate a profit for the business. Larger companies may look at the break-even point when investing in new machinery, plants, or equipment in order to predict how long it will take for their sales volume to cover new or additional fixed costs. Eventually the company will suffer losses so great that they are forced to close their doors. The BEP in dollars is $30,000 as shown in the computation at 2,000 units.

The breakeven point would equal the $10 premium plus the $100 strike price, or $110. On the other hand, if this were applied to a put option, the breakeven point would be calculated as the $100 strike price minus the $10 premium paid, amounting to $90. Assume an investor pays a $4 premium for a Meta (formerly Facebook) put option with a $180 strike price. That allows the put buyer to sell 100 shares of Meta stock (META) at $180 per share until the option’s expiration date.

- However, costs may change due to factors such as inflation, changes in technology, and changes in market conditions.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- In accounting terms, it refers to the production level at which total production revenue equals total production costs.

- This break-even point is the level of output (in units or dollars) at which all costs are paid but no profits are earned, resulting in a net income equal to zero.

The graph shows dollar information on the \(y\)-axis and the level of output on the \(x\)-axis. Our online calculators, converters, randomizers, and content are provided «as is», free of charge, and without any warranty or guarantee. Each tool is carefully developed and rigorously tested, and our content is well-sourced, but despite our best effort it is possible they contain errors.

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Businesses share the similar core objective of eventually becoming profitable in order to continue operating. Otherwise, the business will need to wind-down since the current business model is not sustainable. Let’s show a couple of examples of how to calculate the break-even point. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Finding the break-even point of your business allows you to determine how much more revenue you need to generate in order to reach a profit. Conversely, it can also help you determine how many costs you need to cut to reach profitability. Out of the several ways to measure your business’s profitability, calculating the break-even point is one of the most simplistic.

You can adjust variables, fixed costs, sales price, and volume metrics in each analysis to determine how much to budget for each of those costs. When starting a new business, this analysis can help you find out if your business idea is financially viable before you invest too much time or money. For example, If intro to bookkeeping and special purpose journals your startup costs are $50,000 and your product sells for $50 with a $20 production cost, break-even analysis shows you’ll need to sell roughly 1,700 units to cover your expenses. From there, you can decide on pricing, production, and sales targets so your business can stay on the right track from the get-go.